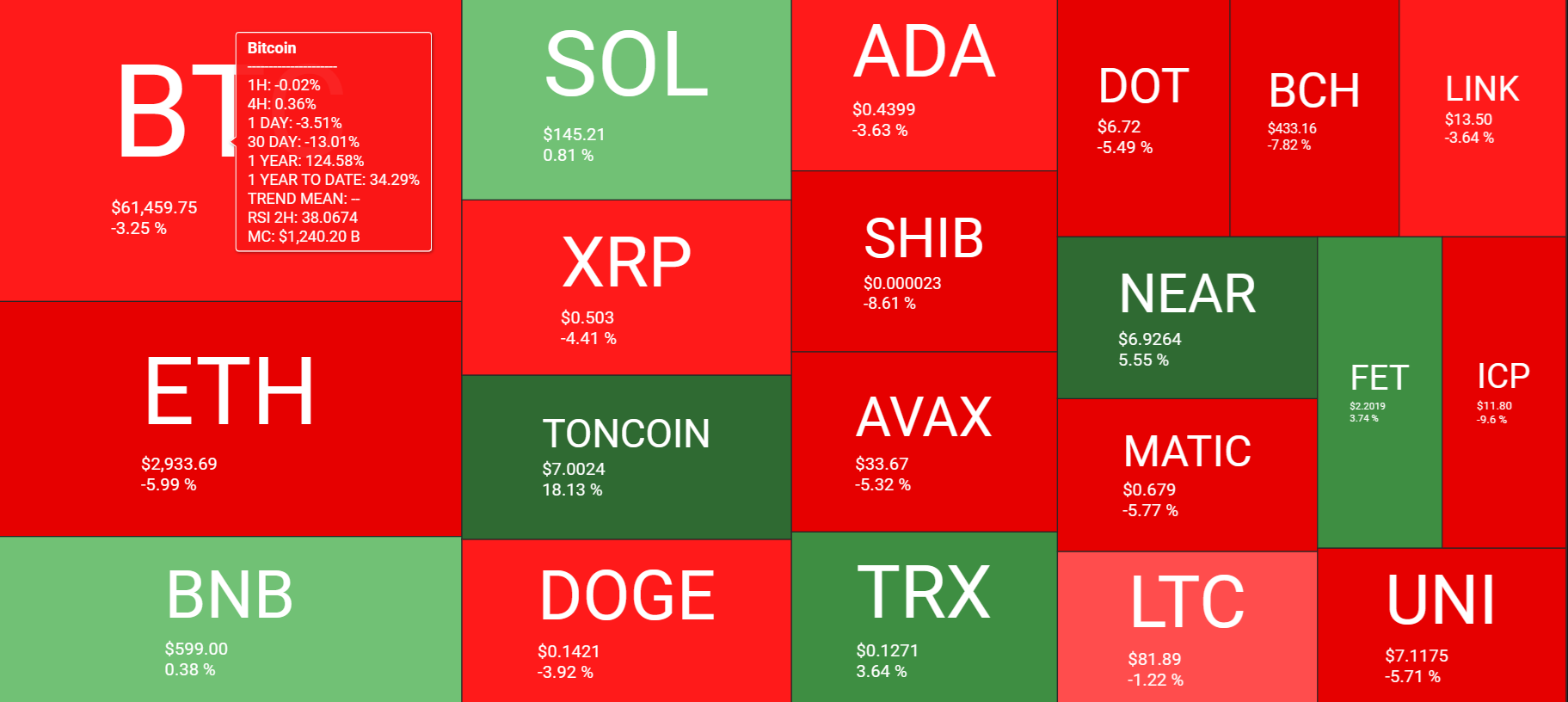

Bitcoin fell over 4% across the previous week despite solid gains in stocks and only a modest increase in the US dollar. Bitcoin briefly spiked above $65,500 on Monday, May 6, before falling to a low of almost $60,000 on Friday. Bitcoin is trading at $61,500 as we head into the new week. The cryptocurrency fell 14% across April and trades flat in May amid choppy moves as investors continue looking for new catalysts post-halving.

Altcoin performance

Last week’s selloff wasn’t contained to Bitcoin; altcoins also fell across the week. Ether, the second largest cryptocurrency by market cap, fell 6%, dropping below the key $3000 level. Ripple (XRP) also experienced a decline, falling 4.4%. However, a few altcoins managed to book gains last week. Binance coin (BNB) and Solana (SOL) rose by 0.3% and 0.8% respectively. Toncoin outperformed, gaining 18% across the week.

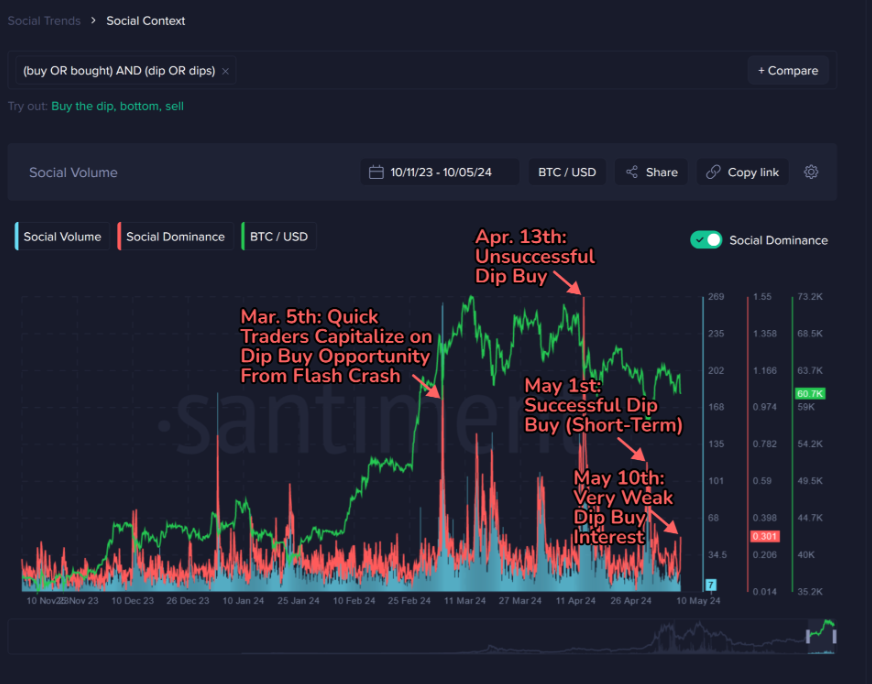

The selloff in Bitcoin and Ethereum coincided with a drop in social volumes for the cryptocurrencies. According to data from Santiment, Bitcoin social volumes fell 15% across the week, and Ether’s dropped 11%. Notably, social mentions of “Buy the dip” or “bought the dip” were low. This could indicate that traders are becoming less enthusiastic about buying the dip, potentially signaling that the market bottom is approaching.

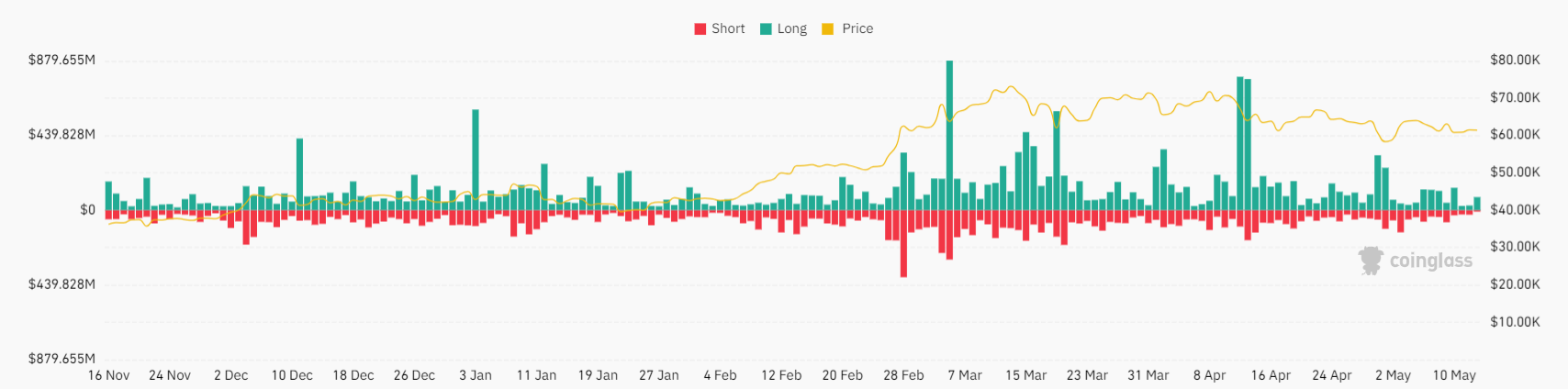

Bitcoin long liquidations

This week-long position liquidation has been greater than short position liquidation. As the process of Bitcoin and Ether tumbled on Friday, the selloff prompted a fresh wave of long position liquidations, pushing total crypto liquidations over $135 million, according to Coinglass data. The data also showed that Bitcoin liquidations reached $50 million that day, with $38 million of long Bitcoin positions liquidated, and the Bitcoin price fell from $63,000 to $61,130.

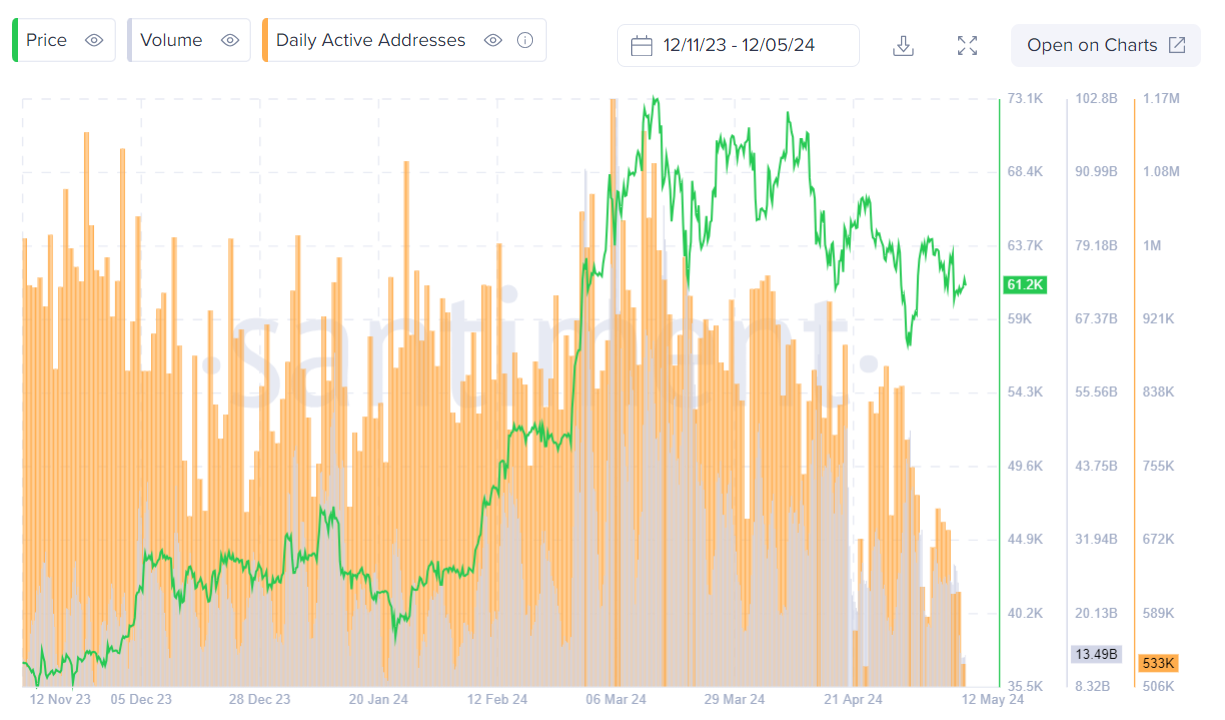

Bitcoin on-chain activity approaches historic lows

Bitcoin’s on-chain activity is fast approaching historic lows as traders have dramatically slowed transactions in the 2-months following an all-time high. According to Santiment, on-chain activity is at its lowest level in years amid a downtrend in metrics such as transaction volumes, daily activity addresses, and whale transaction count. Bitcoin’s on-chain transaction volumes are at the lowest in almost 10 years, while the number of daily active addresses is at its lowest level since January 2019.

As the market navigates this period of consolidation and subdued on-chain activity, broader economic factors are likely to play a pivotal role in Bitcoin’s trajectory in the near term.

Choppy BTC trade & USD loses momentum

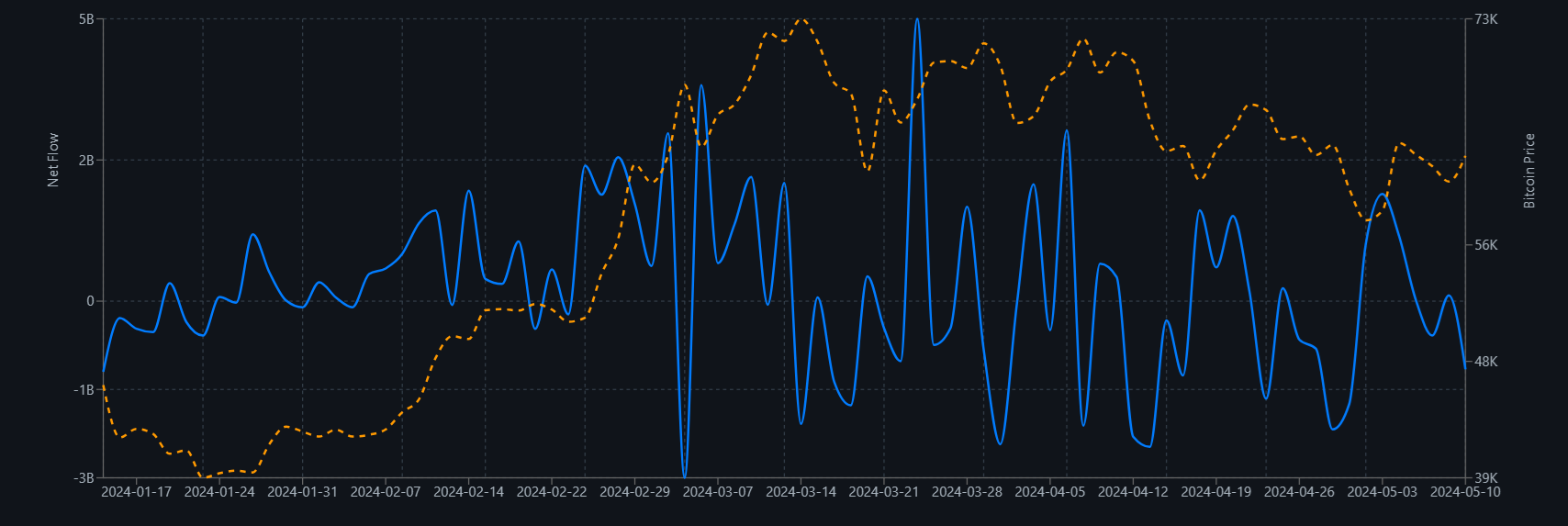

The choppy market performance comes amid an absence of clear macro direction. Macro factors continue to drive Bitcoin’s performance (and altcoins follow) as spot ETF inflows slow and the market searches for other catalysts beyond the halving event almost a month ago.

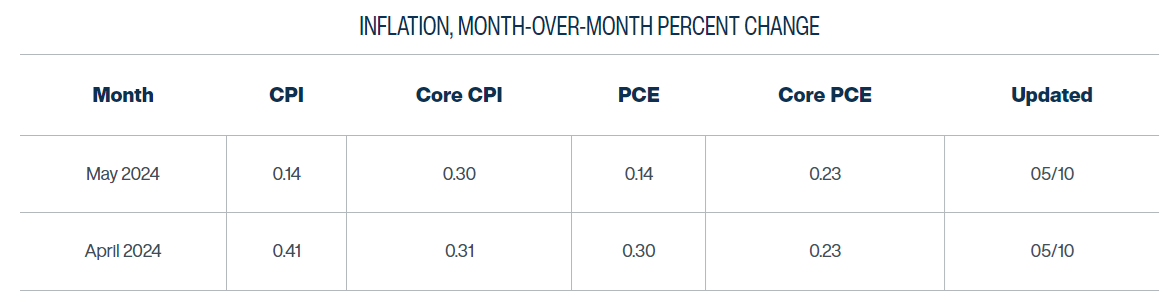

US inflation data and hawkish Fed commentary have continued to raise concerns that the Fed may keep rates high for longer even as the BoE adopted a more dovish approach and the ECB appears on track to cut rates in June. Expectations that US rates could remain high have led to a strengthening of the USD, which has risen over 4% this year against its major peers, which has also weighed down on the border crypto markets.

However, USD bullish momentum stalled following the more dovish-than-expected Federal Reserve meeting and the softer-than-expected non-farm payroll report. Weaker-than-expected jobless claims last week also further supported the view that the Fed could still cut rates in September, given the Fed’s dual mandate to control inflation and keep unemployment levels low.

So far, a few signs of weakness exist in the US jobs market. However, with unemployment at 3.9%, which is still low by historical standards, the Fed is most likely to remain focused on inflation rather than the labour market. This highlights the importance of the upcoming PPI and CPI inflation this week.

ETF inflows taper

US spot Bitcoin ETFs had a mixed performance last week. Last week started on a high note, with US Bitcoin ETFs witnessing a solid inflow of $217 million on Monday, 6 May, highlighting escalating investor appetite for the product.

Notably, the Greyscale Bitcoin Trust saw its first two-day run of inflows since its transition. The source of these inflows is unclear, given the funds’ higher management fees (1.5%) compared to peers (0.5%). However, the inflows were short-lived, and the Greyscale Bitcoin ETFs then saw substantial outflows surpassing the $66.9 million in inflows on May 6 & May 5 as the rare inflows dried up and failed to maintain momentum. Meanwhile, the other approved ETFs saw demand taper off significantly after strong gains on May 6.

What’s been driving the Toncoin rally?

Toncoin has soared 36% so far this month, including a 19% rally last week. It rose to a high above 7 while outperforming the broader crypto market.

Toncoin has more than tripled in value in less than two months, from the February low of 2.0 to current levels of just above 7.00. So, what’s been driving the Toncoin rally? Pantera Capital, a renowned venture capital firm, lifted the outlook for Toncoin with a $4 billion investment in the TON ecosystem. Confidence in TON’s potential is evident, particularly considering its collaboration with Telegram, which boasts 900 million users. Toncoin could become one of the most widely used blockchain networks.

There’s also a lot of buzz surrounding the upcoming launch of the Notcoin token $NOT this week. Notcoin is an interactive game based on Telegram that will utilise the TON blockchain for its token. The game has over 35 million users engaging with it, and the anticipation surrounding Notcoin drives excitement in the TON coin ecosystem.

Look ahead: US CPI & can the Dow Jones extend its run?

Looking ahead, this week’s main focus will be on US inflation data; both wholesale and consumer inflation data will be released and could provide further clues to the market over when the Fed might start cutting rates and the scale of those rate cuts.

The market is pricing in just one 25 basis point cut this year and a 50% probability that the Fed will cut rates in September. Rate cut expectations rose last week after a sharp drop in consumer confidence and weaker-than-expected jobless claims, following a softer US non-farm payroll the previous week. However, signs of sticky inflation could push back rate cut expectations once again.

The Cleveland Fed Nowcast forecast suggests that the headline consumer price index (CPI) will rise 0.4% MoM, and core CPI, which excludes food and fuel, could be 0.3%. Should that forecast hold, it is unlikely to reassure the Federal Reserve policymakers to cut interest rates.

Sticky inflation and more hawkish Fed expectations could lift the USD and pull risk assets such as Bitcoin and stocks lower, potentially ending the winning run in equities. The Dow Jones extended its winning streak to 8 days as the leading indices gained ground for a third straight week. This marks the Dow’s longest winning streak since a 9-day tally in December last year. Whether this rally continues depends largely on inflation data, which will set the tone from here.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.