Crypto markets pulled back last week after several Fed speakers sounded the hawkish tone in their respective remarks and interviews, which led traders to believe that the rate hiking cycle may not be over. This revelation caused crypto prices to weaken throughout the week, until Friday when Fed Chairman Powell mentioned in an interview that US rates may not have to rise as much as anticipated to curb inflation. While Powell’s slightly dovish comments did not send crypto prices flying, they nevertheless managed to keep prices from falling further.

BTC broke $27,000 but has found support around $26,500 while ETH toyed with $1,800 for the most part of the week. The main outperformer amongst the top coins was LTC, which went against the tide and rose a magnificent 18% when most other top coins were bleeding.

LTC Price Gains Momentum As Halving Approaches

As we already highlighted last week about LTC’s improving fundamentals, the positive showing by LTC is likely to continue as LTC metrics have continued to be in the attractive zone even after its impressive rise last week. One such metric is the MVRV ratio. The MVRV ratio for LTC is still under 1 despite price having risen significantly, which means that it is still trading at an undervalued price relative to its history, even as accumulation has picked up recently.

As LTC nears its halving in August, its price could continue to gain traction as more traders chase the narrative. In previous cycles, in the 90 days leading to LTC’s halving, its price had historically risen by around 300% before retreating immediately after the actual event.

The current positive narrative around LTC could be especially pronounced now when fears surrounding BTC and ETH are more elevated than usual after the price of both top coins have broken downward in recent days.

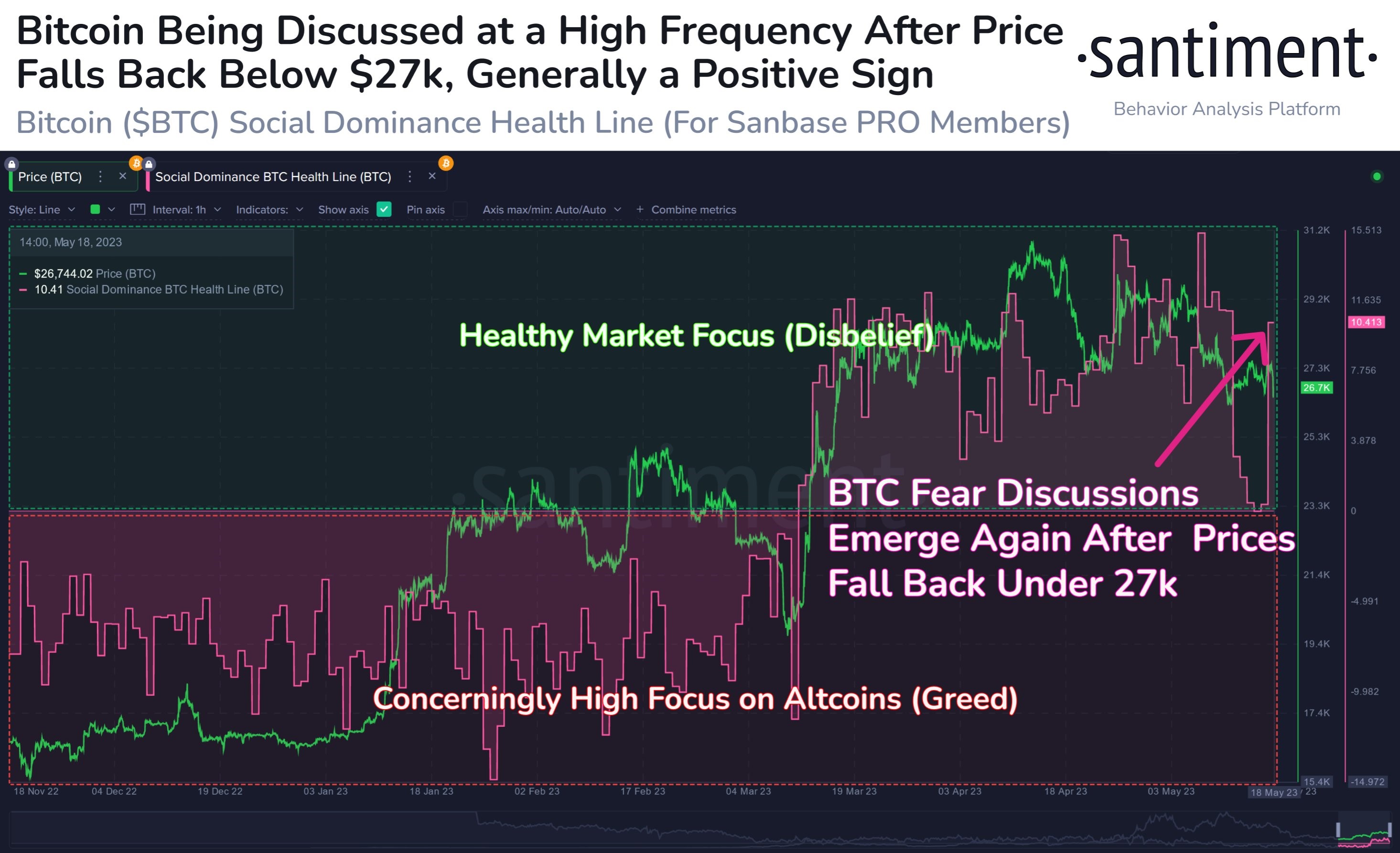

With BTC having broken the $27,000 level, traders have been showing increased concerns of the possibility that BTC could fall back to the $20,000 to $25,000 range. BTC’s bearish social dominance has jumped high again, typically a sign of fear amongst retail traders. That said, such widespread fear amongst traders usually signals an increase in the probability of a contrarian rebound in price.

In other words, this level of fear in the market could in fact be a good opportunity to accumulate rather than sell, especially when the volatility of BTC is at a historically low level.

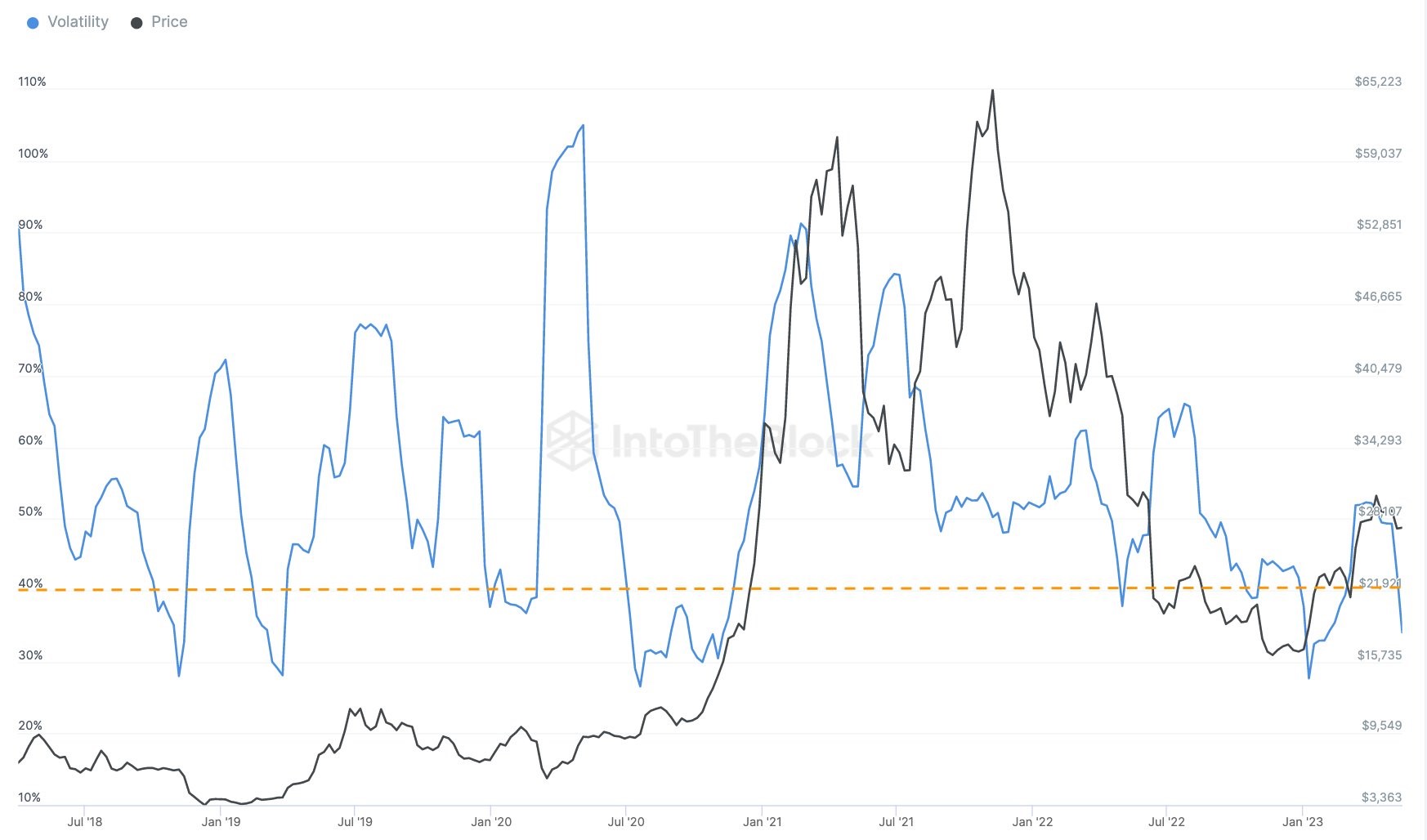

BTC Historical Volatility Points To Possible Gain Ahead

As can be seen in the diagram below, BTC’s 60-day annualized volatility has fallen below 40% again currently. This is the 8th time it has fallen to such a level in the past 5 years. Historically, whenever BTC’s volatility drops below this level and bounces back, its price has gained around 45% in the subsequent 6 months. Thus, should the price of BTC continue to consolidate around this area without any big up or down movement for the rest of May, it may be a good sign that an upswing could be in the works in the second half of the year.

BTC As Reserve Asset Could Reignite After Tether’s Move

As traders wonder where new BTC buyers would come from to keep its price from falling, support in the form of using BTC as a reserve asset has come from Tether. Last week, Tether announced that it would, with immediate effect, invest up to 15% of its profits in BTC as it diversifies its reserves towards crypto and away from US government debt.

Tether had recently reported a net profit of $1.5 billion in 1Q2023, and 15% of it would provide an additional $225 million towards buying BTC. While the amount is not large, the move from Tether could encourage other firms to follow suit, especially when confidence in the traditional banking sector has been eroded in recent months due to the closure of several US banks.

Even though an additional $225 million to purchase BTC may not move its price upwards by a big margin, the news may provide some relief against short sellers who could be the culprits of BTC’s recent price fall. As recent data suggests, only short-term holders that bought BTC in the last 3 to 6 months have been active in selling BTC, while long-term holders, who are the backbone of BTC, are staying put.

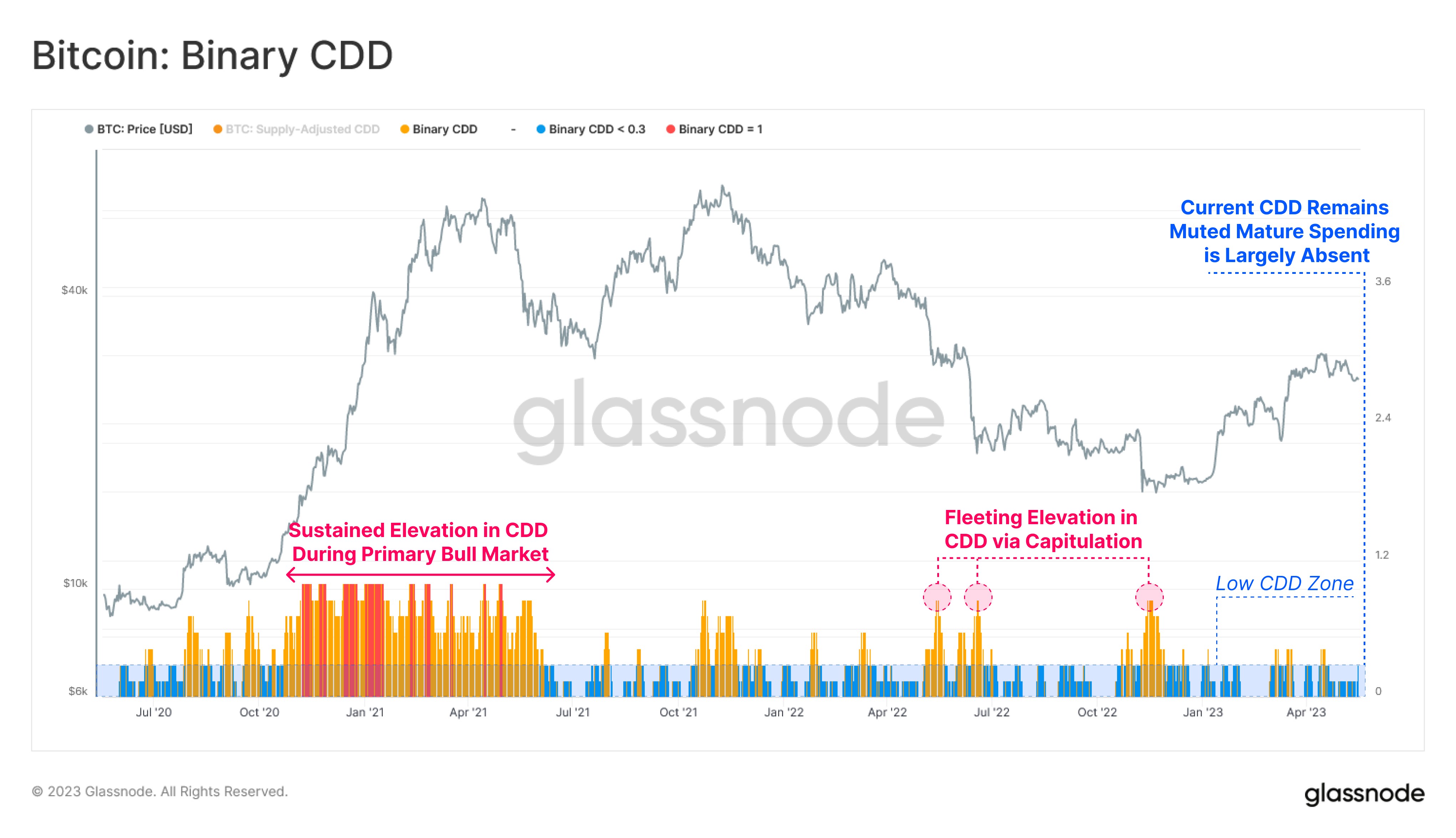

One particular metric, the Coins Days Destruction (CDD), shows that most long-term holders have not been selling BTC even despite its recent weak price performance.

BTC CDD Suggests LTH Are Standing Firm

The current level of BTC’s CDD remains heavily muted when compared with previous cycle tops and periods of capitulation, which saw surges in CDD before subsequent large price drops.

This low CDD value could imply that mature coins, which have been held for long periods of time, are remaining largely dormant and there is no sale of old coins, which is in line with the early stages of a bullish market structure.

XRP Edges Higher Amid Positive Signals From Lawsuit

A motion from the SEC to seal records of its internal deliberations following a speech by former director William Hinman has been denied by the US court in the latest update in the Ripple-SEC lawsuit. The move has been seen as a win for the Ripple and crypto community and held up the price of XRP even in the midst of a market-wide correction in crypto prices. The price of XRP rose by 10% as a result. Further to this positive news, Ripple also announced that it will acquire Swiss crypto custody firm Metaco in a $250 million deal.

Debt-Ceiling Talk Postponement Mired Week of Gains For Stocks

In the traditional markets, the second postponement of the debt-ceiling negotiations between US legislators mired a positive week which saw notable gains from tech stocks. However, traders remained hopeful that a deal would be struck this week, hence, despite some losses on Friday, the major US averages still closed higher for the week as a risk-on sentiment enveloped the markets.

Such sentiment was boosted by less hawkish comments from Fed Chief Powell who said that rates may not have to rise as much as initially anticipated to contain inflation – Powell’s comment was especially welcomed after various other Fed speakers gave more hawkish guidance throughout the week. However, traders interestingly did not appear to be perturbed by the commentaries as the markets digested the comments by rising instead of falling. By the end of the week, the Nasdaq had risen by 3.04%, the S&P 500 gained 1.65% and the Dow added 0.38%.

The dollar edged a tad lower on Friday after Powell’s remarks, but was up 0.5% over the week as the flight to the dollar was still evident, especially seen from the viewpoint of Gold, which fell 1.6% for the week. Silver too suffered losses, but not as much as Gold, losing only 0.6%. Most of the dollar gains were against the yen, as the interest rate differentials in the pair continued to entice traders to short the yen against the dollar. USD/JPY was up 1.6% for the week.

Oil prices were higher after surprising news out of China. Chinese refiners reportedly dipped into crude oil inventories in April for the first time in 18 months, showing that demand for oil from China could be stronger than what analysts were expecting. By the week’s close, the WTI edged up 2.6%, while Brent Crude rose 2.3%.

This week, the result of the US debt ceiling talks set to resume on Monday could determine the main direction of the markets in the short-term. If a deal is reached, risky assets could rally higher, while a delay could see assets pull-back.

Wednesday will see the release of the minutes of the last Fed meeting, while the preliminary US GDP reading and unemployment claims will be out on Thursday. The week will close off with the release of the Fed’s favorite inflation gauge, the PCE price index. A lower than expected reading would likely reduce bets of another 25-bps rate hike in June’s Fed meeting, which traders have priced in at a 40% possibility at the moment.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.