As the markets had anticipated, the Fed hiked rate by 75-bps on Wednesday but investors turned out to be a little too complacent about the rate pausing narrative which caused stocks to fall after Fed Chair Powell hinted at no pause in hikes in sight, while at the same time, upping the terminal rate even higher, citing the strong labour market as a rationale for supporting more rate hikes in the face of rising inflation expectation. The Fed’s rate decision came after the release of strong jobs data, with better-than-expected non-farm payrolls for October showing a resilient labour market. The JOLTS report on Tuesday also showed that job openings increased despite the Fed’s aggressive tightening clip.

Tech stocks and consumer discretionary stocks were the most badly hit, with the Nasdaq losing the most. Even though stocks rebounded on Friday after a mixed bag in the payrolls report, they still ended the week lower. The Dow shed 1.4%, ending four weeks of gains, while the S&P and Nasdaq fell 3.35% and 5.65% respectively, breaking two-week winning streaks.

October’s nonfarm payrolls report released on Friday gave investors some comfort as it wasn’t a straight-out good number. While the new payrolls added beat expectations, with 261,000 jobs created vs expectation of 195,000, the unemployment rate rose to 3.7%. Expectation was for a rate of 3.6% while the rate in September was 3.5%.

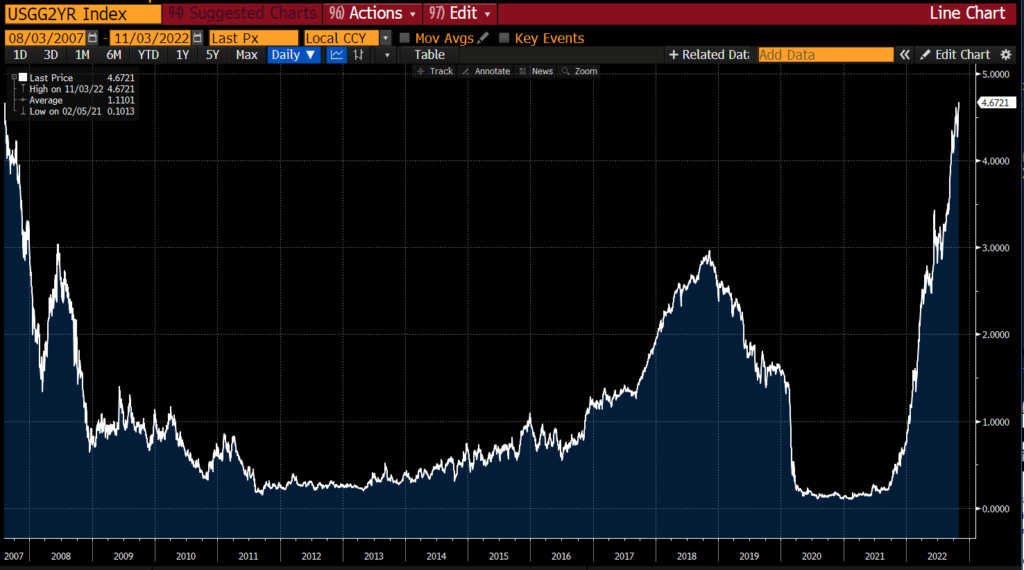

Nonetheless, US Treasury yields surged, with the 2-year yield surging to one of its fastest rises in history, and the 10-year yield is now firmly above 4%.

Rate Hike Race in Europe Sends Dollar Lower

However, the dollar declined after other central banks also signalled to continue hiking rates. While the RBA only hiked 25-bps vs expectation of 50-bps, the BoE and ECB turned out to be more hawkish and could be hiking rates for longer than what the Fed would, which caused the euro to rise.

The BoE also hiked rates, this time by 75-bps, its eighth successive hike and the biggest hike it has ever done in 33 years. However, the central bank issued a warning that it expected a recession to last for all of 2023 and the first half of 2024.

In Europe, Euro zone inflation has hit a record high of 10.7% in October even as growth showed a sharp decline. GDP figures released on Monday showed a 0.2% growth for the euro area in 3Q as opposed to a 0.8% growth in 2Q. Despite growth slowing, the high inflation number has gotten experts to price in a 75-bps rate hike in their December meeting instead of previously anticipated 50-bps, leading to a 2.5% jump in the EURUSD on Friday as investors digested the ECB’s guidance.

With the dollar’s decline, Gold and Silver advanced slightly. Gold rose about 3% while Silver popped 10% on hopes of China removing its zero COVID policy and finally reopening. Oil also moved higher on the back of the China news, with both the Brent and the WTI Crude gaining around 6% each. However, prices have retreated by around 1% at the opening of the new week as China was said to have maintained the zero-COVID rule eventually.

Crypto prices inched lower early last week but popped higher at the end of the week in line with the general risk-on mood on Friday.

Despite a stronger dollar in the early part of the week which led to stock declines, crypto prices were not as badly affected. BTC barely moved an inch while ETH only lost $100 but was back higher the next day, again showing that crypto prices may have bottomed.

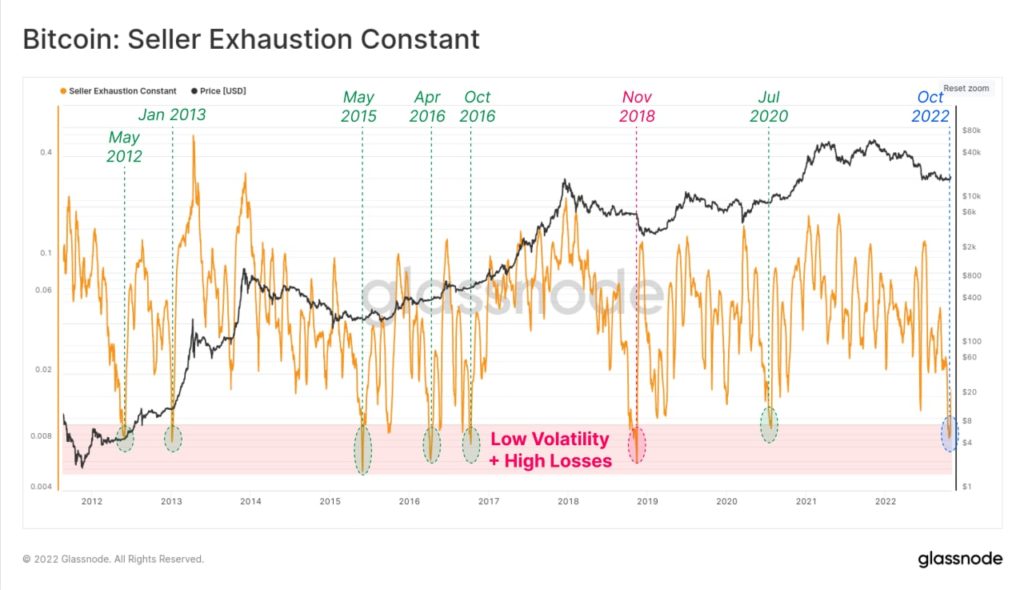

BTC Sellers Exhausted as Price Refuses to Break Lower

The lack of downside volatility in crypto prices could be attributed to seller exhaustion, which has fallen to levels where price could no longer fall deeper into the red in the past.

The BTC seller exhaustion constant has recorded its lowest value since November 2018. This metric enters this zone when volatility is low, but on-chain realized losses are high. With most of the holders in BTC long-term holders, they are not likely to want to sell when they are at a loss, resulting in a lack of selling pressure on BTC. Out of 7 times the metric fell to this region, the price of BTC rebounded to the upside 6 times.

Thus far, crypto prices have indeed bounced, with BTC inching above $21,000 and ETH has popped higher after the market has finally learnt of the increase in whale re-accumulation.

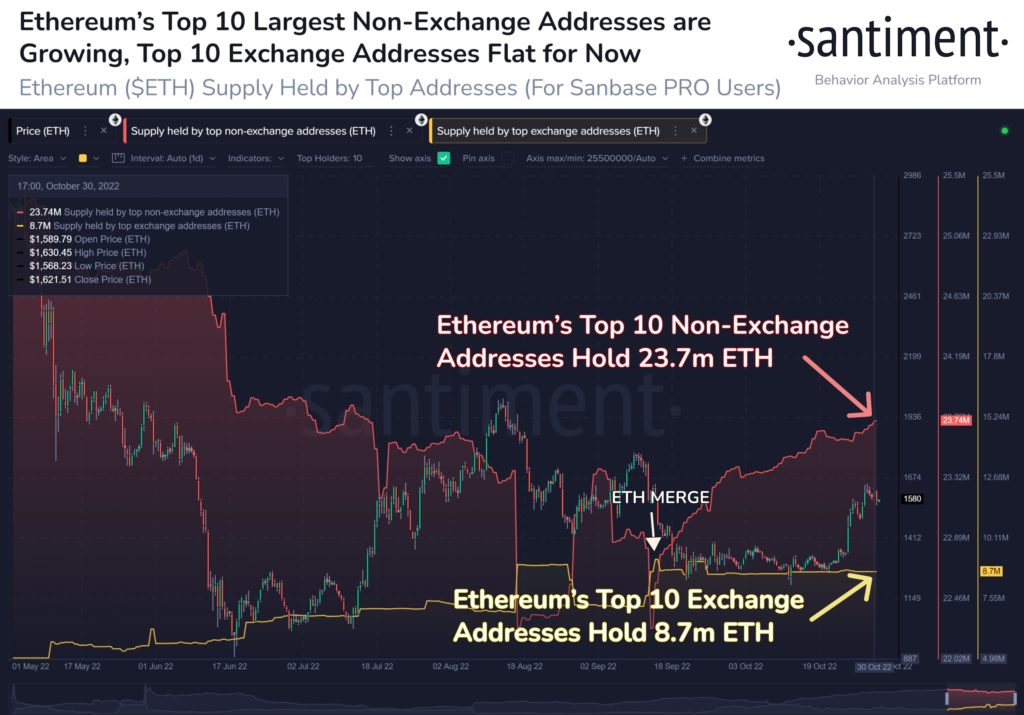

Whales Buying Back ETH Post Merge

After some selling ahead of the Merge in September, ETH whales are back buying ETH again. The top ten non-exchange addresses have added 6.7% more ETH post Merge, showing that their confidence in PoS is growing, this is good news for the price of ETH, as the top 10 exchange ETH reserves have grown by only 0.2%, implying a lack of spot selling pressure on ETH.

Signs of Altseason as Crypto Prices Pop Higher

There was a lot to cheer about in the altcoin space as the week was filled with adoption news. Other than Elon and CZ’s aim of transforming Twitter into a web3 platform, which caused massive rallies in the price of DOGE, BNB and MASK, Instagram also caused MATIC to surge as the platform announced that it would allow users to trade Polygon NFTs on the Instagram app.

Another positive adoption news came from Moneygram, which has announced the launch of a new service that will allow users of the MoneyGram mobile app in the USA to buy, trade and store cryptocurrencies. The service will start with three cryptos in the beginning, which are BTC, ETH and LTC, and will expand to more cryptocurrencies and to other regions in the future.

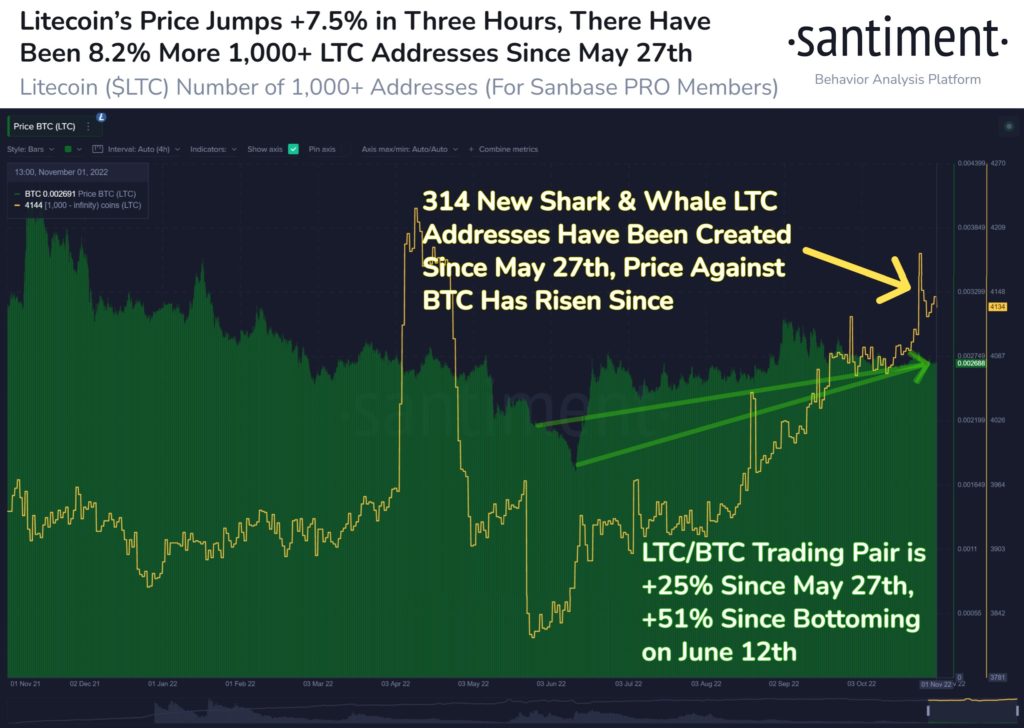

While the news did not move BTC and ETH by a big margin, it helped LTC jump by more than 13% overnight, rising above $63 at the time of writing. Litecoin founder Charlie Lee even took to Twitter to celebrate the news.

The number of addresses with 1,000 or more LTC has grown rapidly since mid-June, and LTC’s price vs BTC has grown 51% since June 12th.

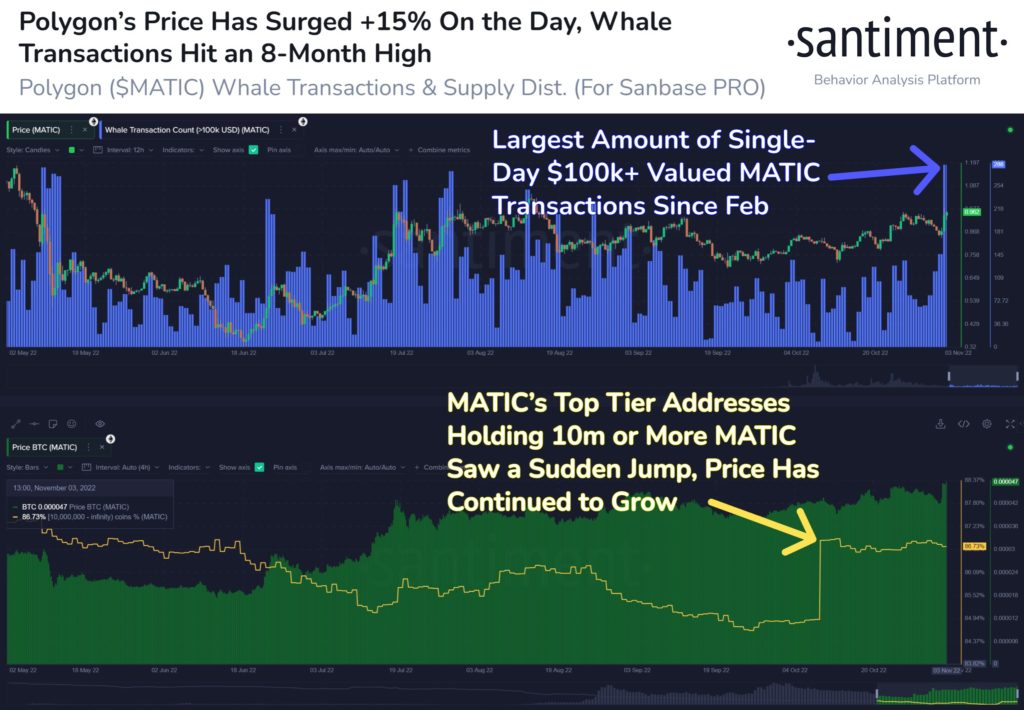

Following the Instagram announcement on Thursday, MATIC saw the highest amount of whale transactions worth more than $100,000 each since February. This announcement was foreshadowed by a spike in holdings of MATIC whales that had more than 10 million MATIC tokens in mid-October, who could have known in advance of the news. Hence, whale watching in the crypto market once again proves to be profitable. MATIC has since gained more than 30% for the week.

Not to let MATIC take all the glory, SOL also surged a good 20% after Google revealed that the company is running a Solana Node.

As Fed speakers are free to voice their opinions to the public again after last week’s Fed meeting, watch for volatility in the dollar as what each official say could swing the dollar one direction or the other. However, the key risk event this week will be the US CPI, which will be released on November 10. While this may move the dollar and stock markets, it is not expected to have a significant impact on crypto prices as crypto appears to be trading under their own fundamentals.

Crypto May Have Shaken Away Macro Headwinds

What crypto traders may want to watch out for in the near-term may be the developments in Twitter now that both Elon and CZ are in the midst of transforming the company into a web3 platform. News flow out from there could potentially impact BTC, ETH, BNB, DOGE, MASK, Polygon and some other tokens as Elon has revealed in a forum on Friday that he wants to transform Twitter into the X.com super platform that he envisioned 22 years ago, while CZ from Binance has in various media interviews last week, opined that he believes Twitter has the potential of bringing web3 to the masses.

Meanwhile, XRP fans may also have a lot to be excited about as rumours of Ripple getting into a settlement meeting with SEC has made its rounds beginning on Friday. While the said meeting has not been confirmed by either parties, the rumour did manage to send the price of XRP higher by about 10%. Hence, developments from the Ripple lawsuit could also have an impact on the crypto market as a win for Ripple would dilute the SEC’s power to preside over the crypto ecosystem.

This Tuesday, the US midterm election will also take place, however, it is not expected to have much impact on crypto markets. However, history has suggested that risky assets usually perform well in the first 12 months post a US midterm election.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.