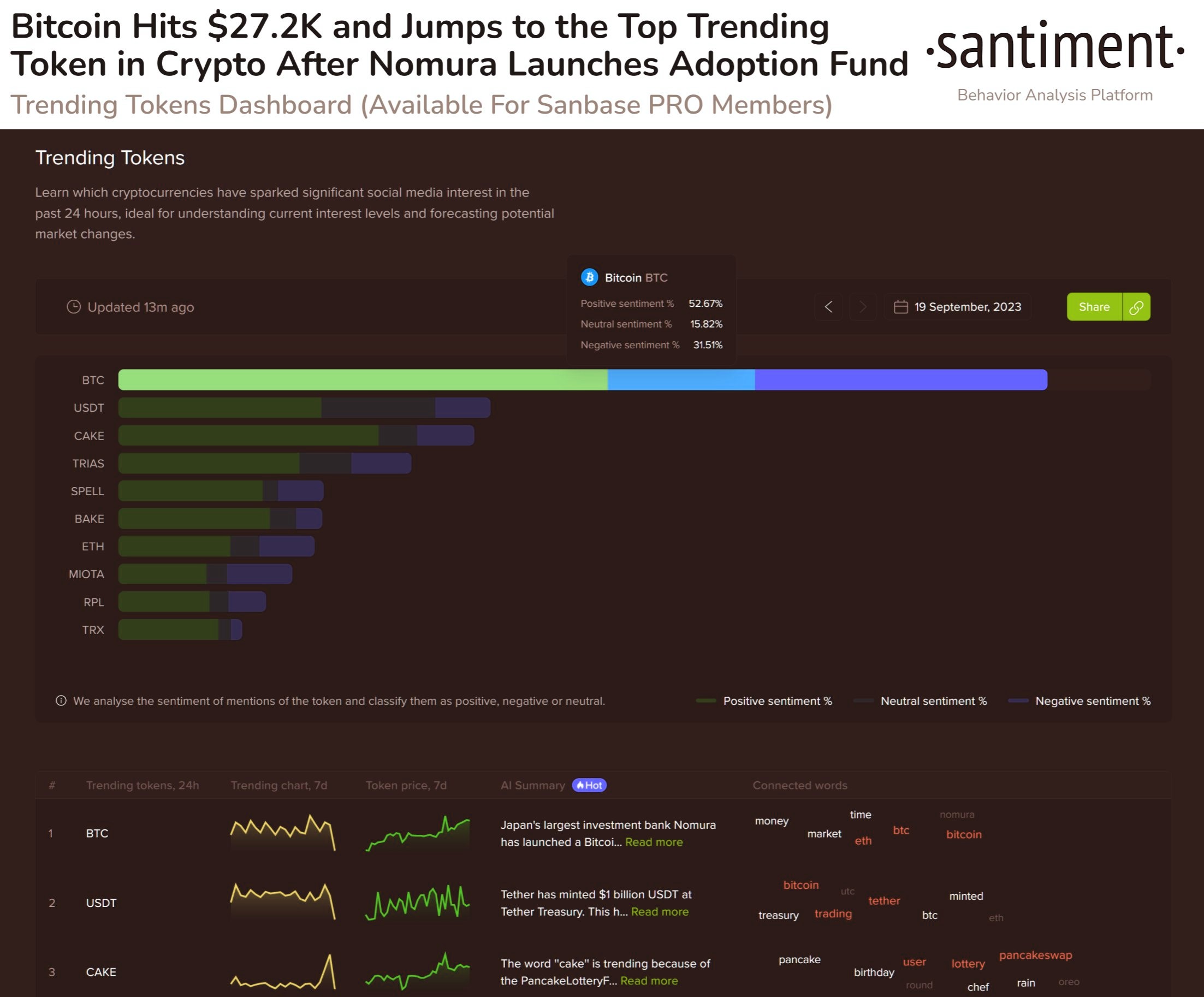

More institutional participation in crypto was announced last week, as news of Nomura and Citi Group both launching crypto products for institutional investors broke. This positivity has managed to keep crypto prices elevated as we had anticipated in our previous week’s report.

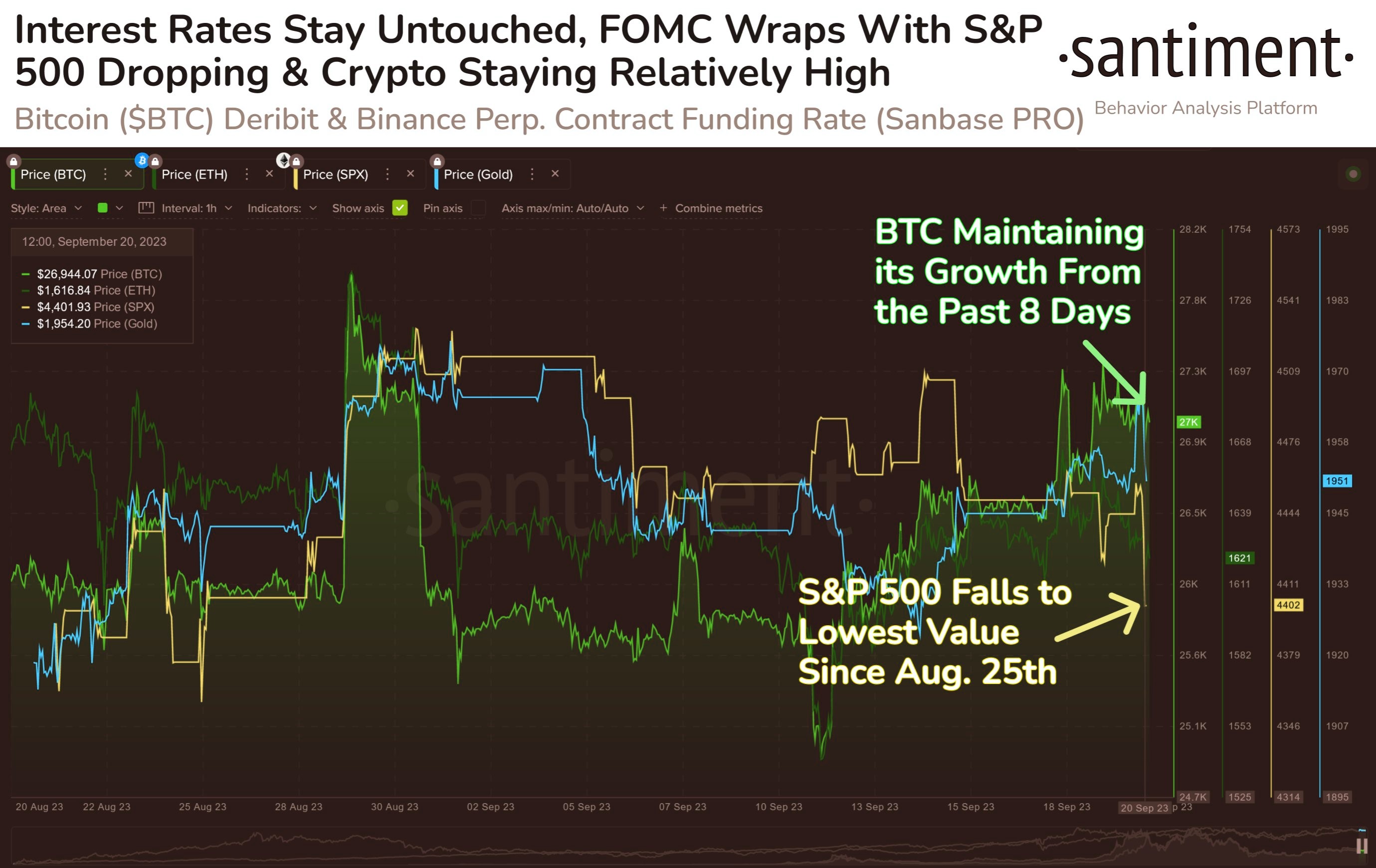

In fact, following the hawkish comments by FED Chair Powell about keeping rates higher than previously telegraphed, crypto prices remained resilient even when stocks were selling off. Although it is still too early to tell, this could be a good start towards a potential decoupling of the correlation between tech stocks and crypto – even when the Nasdaq dropped 1.5% on Wednesday following the FED meeting, BTC managed to hold on to $27,000 at least on the day itself.

Even though the price of BTC eventually pulled back to below $27,000 by the week’s end, its relative resilience compared with tech stocks, which had fallen by a much larger magnitude last week, stood out rather evidently. One ingredient that could keep this trend of BTC outperformance going could lie in the behavior of BTC long-term holders.

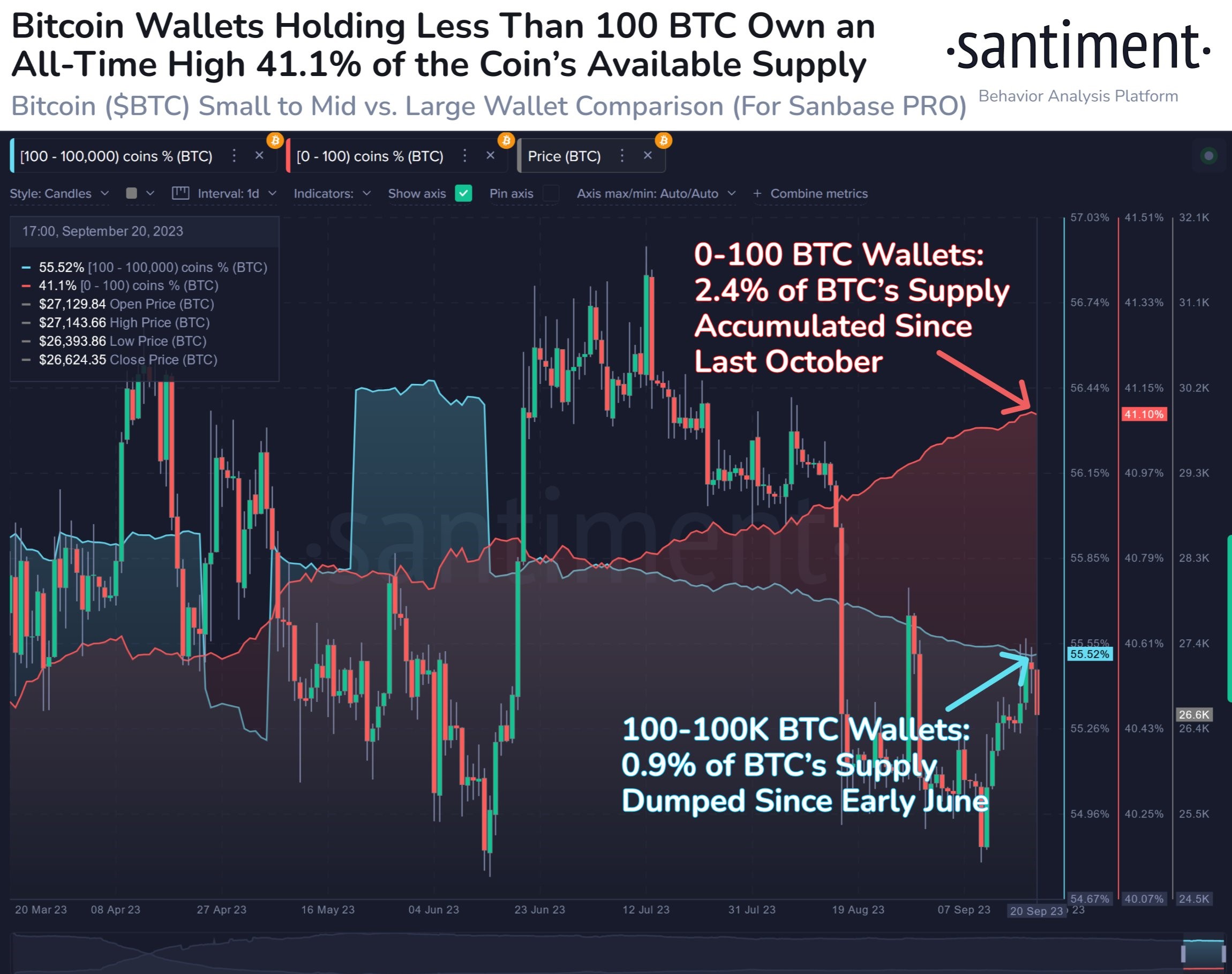

Small BTC holders could support price

Since late last year, smaller BTC wallets with less than 100 BTC have relentlessly continued to add to their BTC holdings. Up till now, they have added around 2.4% of BTC’s supply since last October, with their pace of accumulation outpacing the sales from larger whale wallets. This has caused a net increase in demand, which invariably reduces the active supply of BTC.

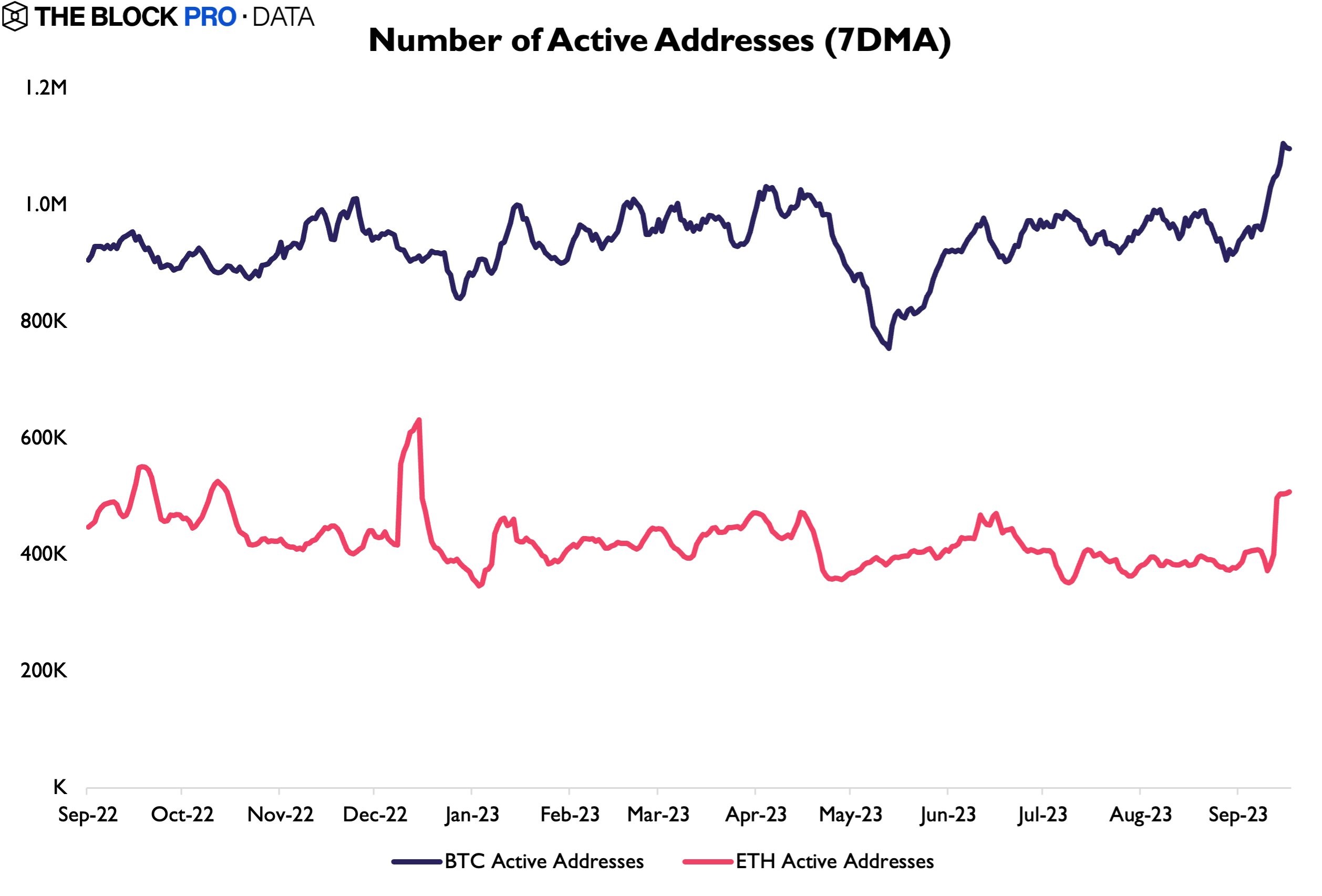

Notwithstanding the fact that purchases have been increasing more than disposals, last week even saw the number of BTC active addresses pick up substantially. This phenomenon was not only apparent in BTC, but was apparent in ETH as well.

The 7-day moving average of BTC active addresses rose from 906,000 to over 1.11 million, hitting levels not seen since 2021, while that of ETH spiked from 372,000 to 508,000, the highest the average has been in 2023. While such data does not necessarily indicate that prices could rise soon, it at least signals that activities on the two blockchains are showing signs of improvement, which is bullish should the trend persist.

Mt Gox repayment postponement a positive for BTC

Mt Gox has also provided another reason for BTC’s price to be supported in the meantime. Late last week, the Mt Gox Rehabilitation Trustee changed the deadline of the Base Repayment, the Early Lump-Sum Repayment, and the Intermediate Repayment from 31 October 2023 to 31 October 2024. Many crypto investors had been worried about the impact of the Mt Gox redemption as Mt Gox holds an estimated 142,000 BTC, 143,000 BCH, and 69 billion yen, among other cryptocurrencies. As such, news of this postponement could be positive for the price of BTC at least until mid-October, which is the next deadline for the SEC to announce the results of the spot BTC ETFs applications.

According to the NYDIG, 13 October is the last date for the SEC to appeal the decision of the Grayscale case, while in addition, the SEC must also respond to the Bitwise Bitcoin ETP Trust before 16 October and respond to Nasdaq’s request to list the iShares Bitcoin Fund before 17 October. Of course, the SEC will still have the liberty to approve, deny or delay its decisions to a later date.

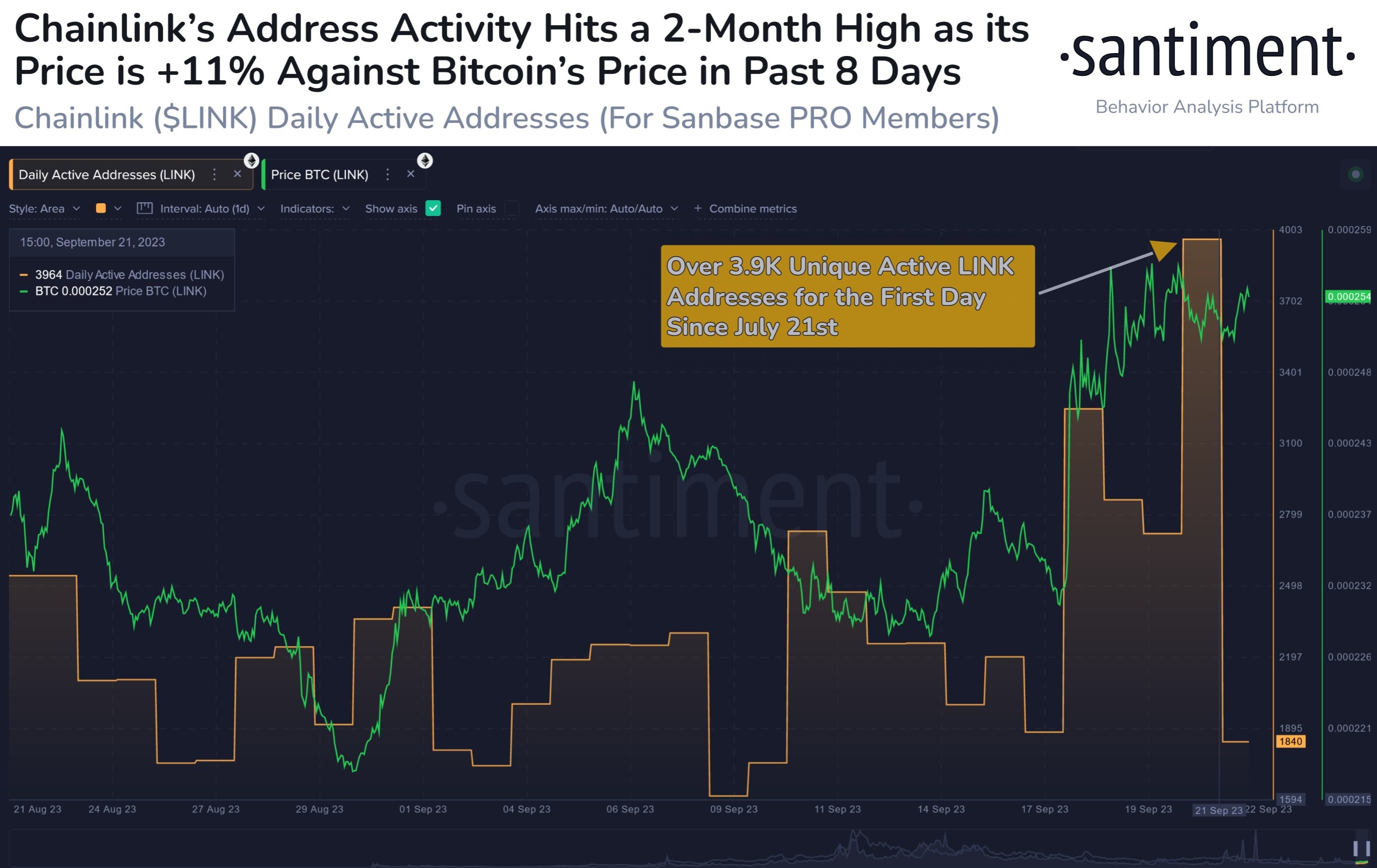

LINK sees plenty of new accumulation

After we highlighted our readers to put LINK on your radars, last week, at least 84 new LINK wallets were created that started to purchase around 4.7 million LINK tokens. The amount of unique LINK addresses interacting on the network also hit 3,964 on Friday, its highest level in 2 months.

While this also may not necessarily mean that the price of LINK is going to explode, the price of LINK has nevertheless outperformed the market, recovering above $7 for a gain of almost 20% last week. However, whether this series of purchases would lead to yet higher prices in the coming days for LINK may depend on how the broad market performs. Over the longer-term though, this is a bullish sign for the price of LINK.

Stocks fall as US yields rise to highest in 17 years

As expected, the FED left rates unchanged at last week’s meeting, but signaled that another rate hike could be coming before the end of the year. FED Chair Powell also signaled that the central bank would end its hiking campaign after that increase and begin cutting rates next year, but would keep rates at a higher level than initially signaled in June. Powell also commented that a soft landing for the economy was still possible and was his primary objective, but not his baseline scenario – this comment somewhat hinted that the FED was of the opinion that the US economy would eventually succumb to a recession next year.

Stock investors did not like what they heard and the immediate response was a selloff. The end result of it was that the S&P fell 2.9% and the Nasdaq tanked 3.6%, ending at their lowest levels for the week, while the Dow slid 1.9%, also ending at its lowest point for the week.

Needless to say, US yields spiked. The 2-year Treasury yield jumped to its highest level since July 2006, while the 10-year Treasury yield reached a high not seen since November 2007. Those moves raised concerns about the impact of higher rates and put more pressure on tech stocks than on other sectors.

Another concern investors had was the possibility of another government shutdown, which affected stocks but did not appear to have any impact on the dollar as the DXY continued to break higher grounds. This came as no surprise as economies in the Eurozone appear to have completed their rate hike cycle as even the UK, which had been hiking rates for the past 2 years, stopped raising rates for the first time after their rate of inflation came in much lower than expected. As a result of its peers being more dovish than the FED, the DXY rose 0.27% last week as both the pound and euro fell.

Another dovish take by the BoJ also added fuel to the dollar rise, where the Japanese central bank maintained its ultra-loose monetary policy.

The strong dollar did nothing for precious metals however, as Silver posted a 2.3% gain and Gold traded flat. Oil prices finally started a slight retreat after weeks of phenomenal gains, with the WTI losing about 1% and Brent down by 2.18%.

As at the start of this week, precious metals have retreated by a tad while oil prices are around 0.2% higher.

In terms of what could move the markets in the immediate days ahead, Thursday could turn out to be more volatile as Powell is slated to give a talk at Washington. The final 3Q GDP and unemployment claims will also be released on that day.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.