The traditional markets were rife with activity last week as it underwent one of the busiest weeks of central bank action.

The forex markets, in particular, saw one of its highest volatilities outside of a financial crisis as the yen, euro, pound and needless to say, the dollar, saw frenzied trading.

First, after the Fed’s 75-bps rate hike, the US dollar was already surging as Fed officials signalled at least another 100-150 bps hike for this year, sending the bond markets into mayhem as yields surged frantically.

The US 2-year over 10-year Treasury yields has been the most inverted since 1981, signalling panic amongst traders as recession comes hitting them in the face. The 10-year yield has surged to 3.7% while the 2-year yield is now 4.2%. This has caused stocks to tank, with the major US averages closing at the low-of-the-day in its fifth negative week in six. The Dow lost 4%, the S&P shed 4.65% and the Nasdaq slumped 5.07%. Stocks had been losing 4 days in a row in the face of recession and fears that the Fed could over hike.

The only positive in the USA was the surging US dollar, which has gained more than 3% over the week, crushing all other currencies in its wake. The EUR/USD lost almost 4.8%, closing the week at $0.9687, and has continued to weaken at the start of the new week by 0.5%.

Activity in the forex market was especially rife since Thursday after the BoJ intervened in the forex market for the first time since 1998 to stem the yen’s fall against the dollar as the USD/JPY surged to 145.80 yen. However, the move may not have a lasting impact as long as the policy divergence between Japan and the rest of the world continues, as the BoJ maintained its ultra-loose monetary policy stance during its policy meeting on Thursday. Thursday also saw the Swiss National Bank hike rates by 75-bps, ending an era of negative interest rates in Europe.

All these actions however, paled in comparison to the pound, which saw a magnificent fall on Friday after the UK government announced a new economic stimulus plan that included a slew of tax cuts to try and revive its ailing economy. The GBP/USD lost more than 5.5% for the week, with most of its losses coming on Friday. This fall in the pound to levels not seen since 1984 comes even after a 50-bps rate hike on Thursday, as most traders did not like the controversial reform plans. With inflation at a roaring 9.9%, market consensus is for at least another 100-bps rate hike in the BoE’s next meeting to stop the pound from free-falling. Despite this, experts are expecting the GBP/USD to dip below parity by the end of this year, following in the footsteps of the Euro. Indeed, as the Asian markets opened on Monday morning, the pound flashed crashed by 5%, with the GBP/USD losing 5% to hit all-time-low of $1.035 within a few minutes as thin bids caused the GBP/USD to crater. It is now trying to stabilize around the $1.05 level.

Trade volatile currencies with PrimeXBTEuropean stocks and bonds were battered and bruised, with key indices losing more than 3% last week and yields surging to multi-year highs. Investors are increasingly worried about a sovereign debt crisis breaking out in Europe, especially in the UK.

Markets were even more spooked as rumours of a failed military coup on China Premier Xi Jinping started making its rounds over the weekend even as news out from China remains scarce.

The one-sided action in the stock and forex markets gave traders who were on the right side of the market a field day, while it was lesser of a one-way street in the precious metals market, even though both Gold and Silver ended the week weaker by about 2% in line with the dollar’s advance and are around 1% weaker in early Asian trading this new week.

Oil suffered losses for its fourth consecutive week in a row, plunging to an 8-month low amid recession fears and the strong dollar. Brent Crude closed at around $86.15, down by about 6% for the week, while the WTI settled at $78.74, losing about 7% for the week. Both distillates are not doing much as yet in the new week.

The only safety appeared to be in cryptocurrencies, with BTC strangely able to remain resilient amid the meltdown in the traditional markets, perhaps finally showing its independence as a different asset class.

It wasn’t the case at the beginning of last week though, as cryptos started the week on a bearish note, with more than $433 million liquidated on a Monday dip led by ETH.

Around 87% of the positions liquidated were longs, with around 60% of those attributed to ETH.

Most altcoins were also down more than 10% on average, with popular names like MATIC, DOT, SHIB, ADA, leading the falls, before remarkably bouncing higher after the Fed rate hike on Wednesday.

In spite of the raging dollar, BTC managed to keep above $18,000 and select altcoins even managed to surge higher, one of which was XRP, which we had already highlighted to readers to keep on your radar due to persistent whale accumulation.

XRP Price Doubled as Traders Anticipate a Win

XRP surged almost 100% as traders grew more optimistic about the outcome of the lawsuit as both Ripple and the SEC have filed motions for summary judgements early last week. While traders took the SEC’s filing as a sign that they would be conceding defeat, traders should also bear in mind the current macro-economic picture’s impact on risky asset prices in the short-term, as the court ruling could still take some time to materialise.

The positive spin that may end up favouring cryptocurrencies though, may be the melting away of the fiat currencies as witnessed last week in the forex markets. This may have led to some money flowing into crypto assets as a safe haven since cryptos are based on an alternative system.

USDT Whales Scooping Up BTC

USDT holders in particular, have been observed to be active buyers of BTC over the last 7 weeks, adding around $450 million worth of BTC at levels near the $17,500 support.

While it is unknown if this buying is a last-ditch attempt to prevent the price of BTC from breaking lower, the buying has thus far managed to keep the price of BTC above $17,500 in a week that saw the dollar take out all other currencies, which is a remarkable feat.

However, the price of BTC is still not out of the woods yet and the coming weeks could still be precarious as the price of BTC looks for more conviction on its next move. This is especially true since one metric, the NUPL, has turned back lower after a small recovery since June.

BTC NUPL Suggests More Downside Possible

The BTC NUPL (Net Unrealized Profit/Loss) looks at the difference between Unrealized Profit and Unrealized Loss to determine whether the network is currently in a state of profit or loss.

A value above zero indicates that the network is in a state of net profit, while a value below zero indicates that the network is in a state of net loss.

As can be seen in the below diagram, the chart has turned to move down again after rising since June. While the metric starts dipping again, comparing it with previous cycles shows that there is still some way to go before the BTC network experiences a similar drawdown compared with the 2015 and 2019 bear cycles, where the maximum pain was at levels of between -0.5 to -0.7. The current pain level is at around the -0.2 region, which means we may have some room to roam lower before hitting the previously seen turnaround levels for the entire network of holders.

Miners Seen Selling ETH Post Merge

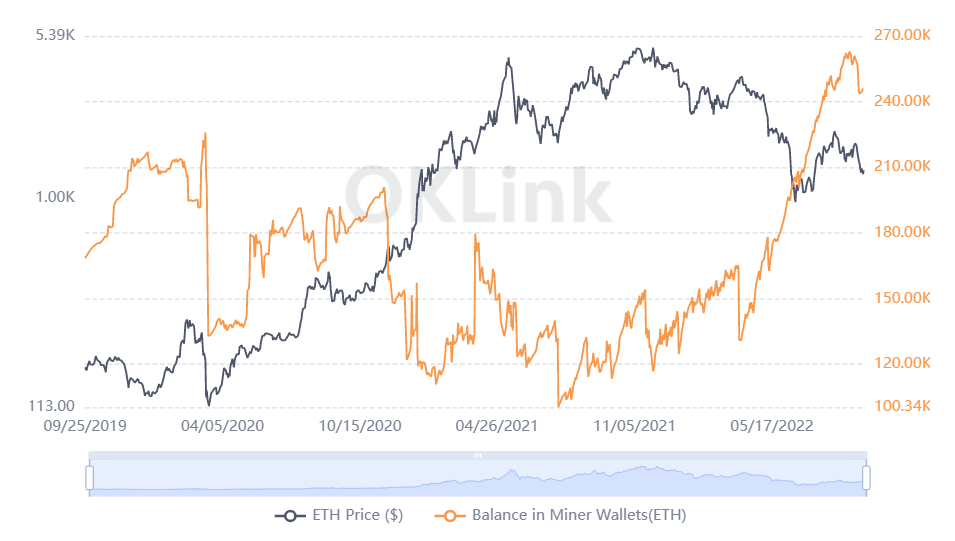

Meanwhile, as BTC decides on a direction, the dust around ETH and its new PoS model seems to be settling well. However, miners who previously were mining on the old PoW network have been selling their remaining stash of ETH. According to onchain metrics, miners were seen disposing of at least 16,000 ETH since the Merge, with around 245,000 ETH left in the accumulated balance of all the miners, some of which could possibly continue to be sold in the event these miners need cash to fund their new mining ventures into other coins. However, there is no way of knowing if miners will sell the remaining balance as they could also stake their remaining ETH to earn rewards.

Regardless, this should not be a deterrent for ETH’s price as 245,000 ETH is a small fraction of the total supply of ETH, which is around 119 million. But should a coordinated attack on ETH’s price be initiated by anti-fans, it is possible to bring the price of ETH lower temporarily due to the negative macro-economic environment.

Could Miners Start Favoring DOGE?

As miners search for new coins to mine, the positive addition of mining power could benefit other PoW blockchains as this could increase the number of market makers to play up the price of other PoW chains. DOGE could possibly be one such beneficiary, as its price increased more than 20% in the past week even when other cryptos had trouble finding a footing.

Accumulation activity on DOGE has picked up last week, as the number of addresses holding between 100 million to 1 billion units of DOGE has increased by 5.13% over just last week alone. Reports cite this increase to be caused by 6 new whales who scooped up around 620 million units of DOGE.

As we have seen before in XRP, should such high volume accumulation continue, it could bode well for DOGE’s price in time to come.

Other than new whales buying DOGE, another whale added some BTC as well. MicroStrategy said that it has bought another 301 BTC at the average price of $19,851, paying around $6 million for them. This brings their total BTC holdings to exactly 130,000 units, acquired for an average price of $30,639 per coin.

Events last week are suggesting that even as the traditional markets burn, crypto whales are adding to their portfolios. Activities in the crypto market in the coming weeks should thus be closely monitored to see if an eventual breaking away of the correlation with stocks could materialise. The other end of the spectrum could be that margin calls in the event of another large dip in traditional markets could ripple through to the crypto market as strings of long liquidations set off a domino effect.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.