Weekly recap:

US global stocks recap

U.S. stocks climbed last week, with the S&P 500 and the Dow Jones reaching record levels on Thursday, but both indices retreated on Friday to close out a mixed week. The Dow settled 1.1% higher, while the S&P 500 fell 0.6% and the Nasdaq 100 closed 1.6% lower across the week. Meanwhile, the USD fell 0.6% over the week, marking its third consecutive weekly decline.

Major US data/themes

For the third straight meeting, the US Federal Reserve met market expectations by cutting interest rates by 25 basis points. The vote had three dissenters, the most since 2019, adding to uncertainty about whether further cuts may be forthcoming in 2026.

After three rate cuts in 2025, markets are pricing in approximately a 70% probability that the Fed will implement two further rate cuts in 2026; however, the Fed dot plot indicates one.

Disappointing earnings from Oracle after the close on Wednesday revived AI bubble concerns, pulling on US tech stocks while cyclicals outperformed.

Gold moves

Gold rose 2.5% last week and is rising at the start of the new week, trading at 4345 per oz at the time of writing as investors bring the record high of 4381 into focus. The precious metal was boosted last week by several tailwinds, including a weaker USD, the Federal Reserve’s 25-basis-point rate cut, ongoing central bank buying, and broadening geopolitical risks, which sustained safe-haven demand.

The focus in the upcoming week will be on U.S. data points, including the November jobs report and the U.S. CPI report on Thursday. Signs of weaker data could fuel optimism for a Fed rate cut, lifting Gold higher. In comparison, Gold rose to a monthly high.

Silver rose to a record high of $64.65, supported by factors similar to those for gold, as well as a global supply squeeze for the industrial metal.

Oil moves

Oil slumped 4.3% last week, marking its largest weekly decline since late September, as expectations of a global supply glut in 2026 and a potential Russia-Ukraine peace deal weighed on prices. The IEA’s forecasts published last week indicate that global oil supply will exceed demand by 3.84 million barrels per day next year, representing about 4% of global demand. These concerns outweighed worries about the possible impact of the US seizure of an oil tanker off the coast of Venezuela. Attention this week will remain on US-Venezuela developments and Russia-Ukraine peace talks.

Indian markets

Indian markets slipped throughout the week as investors reacted to a record-low Rupee and continued selling by foreign institutional investors. The benchmark indices experience significant volatility across the week but remain within a range, suggesting consolidation at higher levels. The Nifty 50 in the Sensex closed the week 0.5% lower at 26047 and 85268, respectively.

Foreign Institutional Investors (FIIs) remained net sellers, offloading Rs 9,201 crore last week and 18,000 crore so far in December, after selling throughout November.

In contrast, Domestic Institutional Investors (DIIs) remain a clear counterbalance, recording solid net inflows of Rs 20,184 crore.

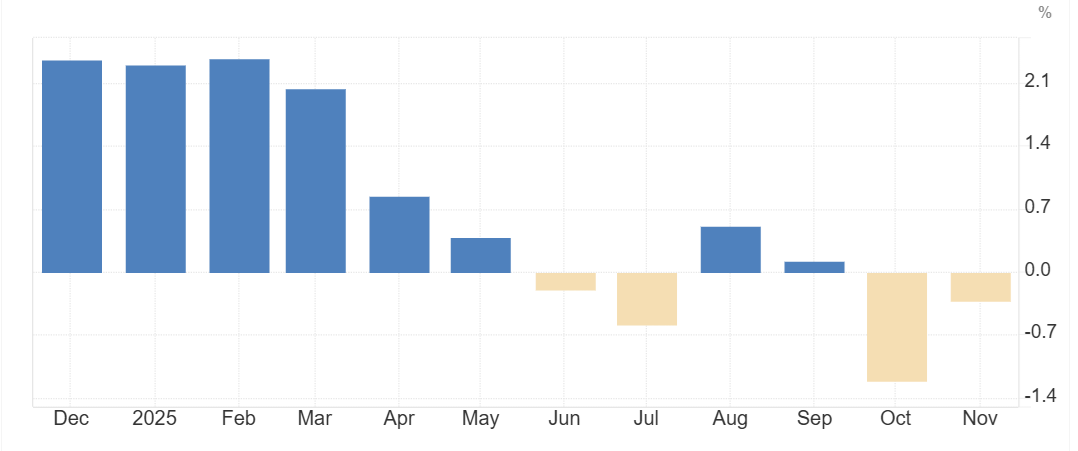

India’s retail inflation rose marginally to 0.71% vs 0.7% expected, but recovering from the 0.25% record low recorded in October, a level that prompted the RBI rate cut. The rise in inflation, including food inflation, was mainly driven by higher prices for vegetables, eggs, meat, and fish. Food makes up the largest share of India’s CPI basket (around 46%)

USD/INR rose 0.71% last week, with the Rupee falling to a record low of 90.65, before settling at 90.54 on Friday. The Rupee has fallen to a fresh record low at the start of the new week.

Pakistan markets

The KSE 100 extended its bullish run last week, rising to a fresh record high. The index gained 1.66% last week, reaching an all-time high of 169,865 in a move that was primarily driven by the IMF board’s clearance of a $1.2 billion disbursement under the Extended Fund Facility (EFF) second review and an additional tranche under the Resilience and Sustainability Facility (RSF). The approval coincided with a landmark settlement of power-sector debt, easing long-standing concerns about circular debt.

Data released last week also supported market confidence. Worker’s remittances for November rose 9% YoY to $3.2 billion amid ongoing support from those working abroad. The auto sector also showed signs of a gradual recovery, with car and light van sales rising 11% MoM and up 52% from November last year.

USD/PKR fell for a third straight week, dropping -0.71% last week, settling at 280.50 on Friday. The pair is extending losses on Monday.

Week ahead (focus US & Asia)

US-India trade talks

US-India trade talks are inching ahead after President Trump spoke with Prime Minister Modi last week, and as negotiators from the US and India work to resolve differences. This was the 4th call by the two leaders since Trump imposed 50% tariffs on imported goods in August, and it shows the two sides are taking gradual steps to reset ties. Although so far, a deal remains elusive. Any signs of progress could help FII flows return and lift the Rupee.

Indian WPI Inflation (Monday)

Indian wholesale inflation was -0.32% amid falling prices for food, mineral oils, crude petroleum, and natural gas. This was up slightly from -1.21% in the previous month and was above the -0.6% forecast.

State Bank of Pakistan rate decision (Monday)

The State Bank of Pakistan is expected to leave interest rates unchanged in its final meeting of 2025. This will mark the fifth consecutive meeting at which the MPC has maintained the policy rate at 11%. In the previous meeting, the MPC cited a lower-than-expected economic impact of recent floods, reducing the need for an immediate interest rate adjustment. It is expected to adopt A cautious approach supporting a wait-and-see stance. Following warnings from the IMF about potential inflationary risks, analysts have pushed back expectations of any rate cuts till late 2026 or beyond. Watch USD/PKR and stocks for any impact.

Indian PMIs (Tuesday)

Indian services and manufacturing PMI data is due to be released on Tuesday. Expectations are for activity to ramp up in both areas of the economy—the services PMI is forecast to rise modestly to 59.9, up from 59.8. Meanwhile, manufacturing PMI is expected to jump to 59.6, up from 56.6. This raises the PMI, a good gauge of business activity, to 60.2 from 59.7, marking a 6-month low reached in November due to weak manufacturing, which fell to a 9-month low in the previous month. Stronger-than-forecast data could help boost demand for Indian equities and the Sensex.

US non-farm payroll (Tuesday)

The November NFP is expected to show 35,000 jobs added, whilst the unemployment rate is expected to remain at 4.4%. The delayed November report will also include October’s payroll, although the unemployment rate will be omitted due to the government shutdown. The last official rate for September was a four-year high of 4.4%, while the Chicago Fed’s real-time estimates rose to 4.44% in November, pointing to an ongoing softening in labour conditions.

High-frequency data points have been mixed with initial jobless claims falling, suggesting a modest reduction in layoff activity. However, the ADP payroll report showed a 32,000-job decline, the largest fall in 18 months. The report also flagged a continued slowdown in pay growth. The Fed’s concern over the weakening labour market has been the reason behind its recent rate cuts. Weak data could reinforce the market view that the Fed will cut twice more in 2026 than it projects, one cut. This could lift Gold and stocks, including the S&P 500, higher, while pulling USD lower.

US CPI (Thursday)

The US CPI release follows the cancellation of October’s report due to the government shutdown. October’s figures are to be incorporated into November’s data where possible. Recent Fed commentary pointed to easing concerns about price pressures and continued disinflation in services. Tariff-driven goods inflation is expected to peak in early 2026, then ease in the second half of next year.

In his post-FOMC press conference last week, Fed chair Powell reiterated that long-term inflation expectations remain anchored and that tariff impacts are expected to be one-offs. Policymakers believe they’ve done enough for now and are well-positioned to decide on next steps as the tariff impact fades in 2026. Cooler-than-expected inflation could raise rate-cut expectations, pulling the USD lower and lifting stocks and Gold.

BoJ rate decision (Friday)

The BoJ will hold a 2-day policy meeting this week, at which it’s widely expected to raise interest rates by 25 basis points, from 0.5% to 0.75%. The market is pricing in an 86% probability of this move, following the BoJ’s decision to leave policy unchanged for most of the year after the January rate hike. Expectations for tightening have risen sharply following a series of hawkish comments from BoJ policymakers, suggesting the bank is preparing for a possible rate increase as early as December.

This was reinforced by Governor Ueda, who said the BoJ would examine the pros and cons of raising rates at the December meeting to achieve the price stability target. These comments sparked a sharp repricing of expectations for rate hikes, with key members of PM Takaichi’s government unlikely to oppose them. The big question is whether this will be a one-and-done move by the BoJ or whether the central bank will leave the door open for further increases.

In addition to the rate decision, the market will also scrutinise the policy statement for guidance on the pace of future normalisation, with a recent poll of economists showing the 69% expect rates to be lifted by a further 25 basis points to 1% by September next year. A hawkish BoJ could drive the yen higher, pushing USD/JPY lower and raising fears of unwinding the yen carry trade, which could hurt risk assets.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.